Dealer SMA Service

Wealthtrac’s Dealer SMA Service enables you to build your own SMAs based on your current model portfolios, with no setup costs.

Build your own SMAs

Wealthtrac manages the compliance, implementation and ongoing investment management. We also negotiate fund manager rebates, paid directly to your clients, lowering total costs compared with your current models.

We’ve recently completed the process for a Dealer in NSW which has achieved improved returns for clients and a $100,000 p.a. cost saving for the practice.

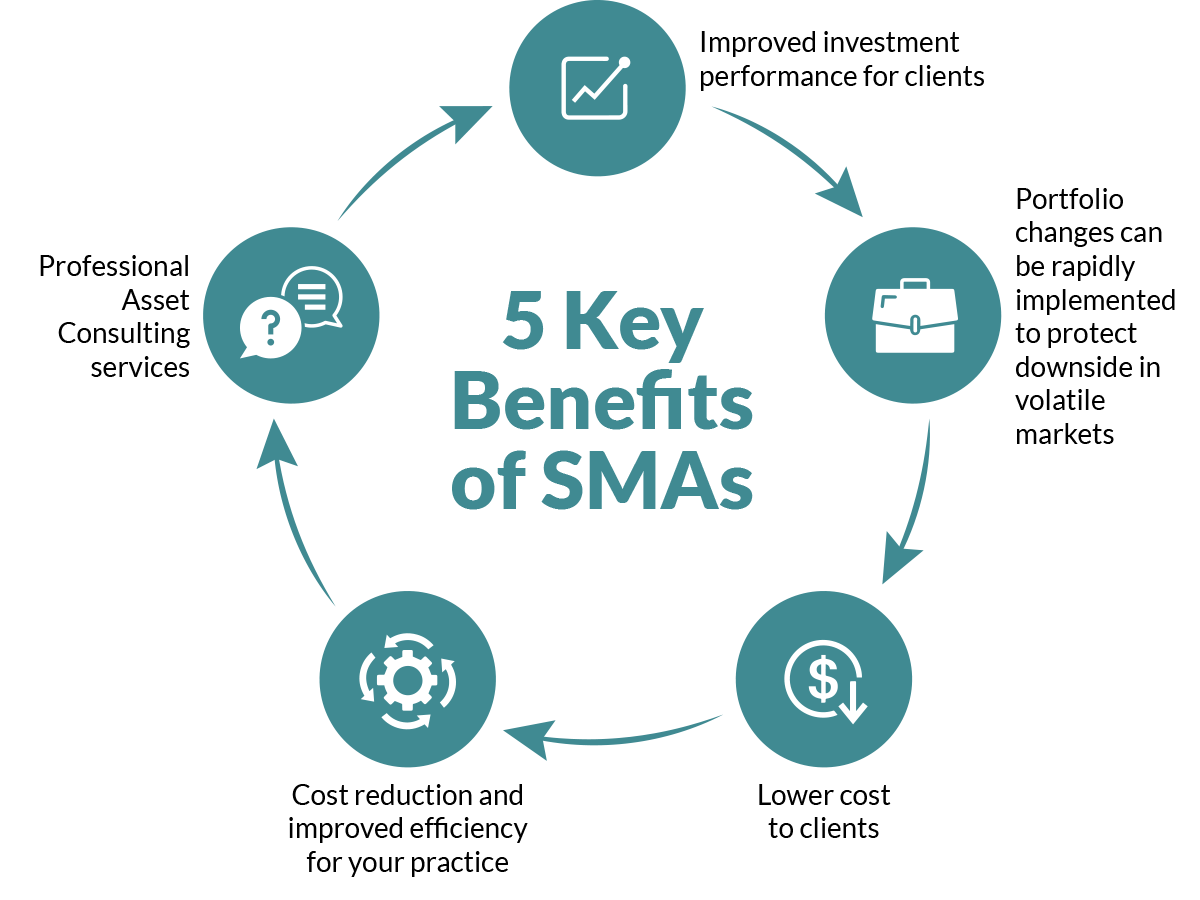

Improved Investment Performance

If you use risk based model portfolios, you’ll know that changing a fund means preparing an ROA for every client, and although not mandatory, it’s best practice to seek client consent before implementing the change.

This creates three costly problems:

- Because of the time to receive client consent and implement the change, you end up with clients with the same risk profile in different portfolios.

- Clients experience performance leakage because it takes too long to implement the change.

- Administering ROAs is expensive and drains valuable staff time.

SMAs completely solve these problems, it has been shown that avoiding implementation leakage can improve clients’ investment performance by 3% – 6% p.a.

Rapid changes to protect Portfolios

You never have to worry about how many changes you need to make to a portfolio, particularly with the volatile markets we are experiencing now, where it may be beneficial to make multiple rapid changes to protect portfolios.

Lower Costs to Clients

We know that using wholesale funds under an SMA mandate generates around 30 bps in fee rebates from fund managers that go directly to your clients’ cash account.

This more than compensates for the cost to set up and manage the SMAs, so clients net returns are improved.

Practice Efficiency

Taking out the costs of continuous ROAs including following up outstanding client responses can save $50,000 – $100,000 p.a. in practice administration costs.

Clients’ Best Interest and Whole of Business Solution

Implementing SMAs to replace Model Portfolios can be demonstrated as, in your clients’ best interest: improved returns and lower investment fees deliver a better outcome for clients.

However you need to consider SMAs as a whole of business solution, where you transition as many clients to your SMAs as possible, as this will achieve the best outcome for both clients and your practice. We invest significant time, resources planning and implementing your SMAs, so we need to be confident you are committed to this strategy. We will discuss timing and minimum FUA commitments with you, as these vary depending on the number of SMAs you want to establish.

Your involvement is two fold:

Once the initial planning and implementation is complete, you will experience immediate benefits in lower costs and increased revenue, this is a business strategy that needs careful consideration, we are here to help and answer any questions you may have.